The automotive aluminum content in the automotive industry is on the rise and will continue to grow. As this trend progresses, how has the automotive industry's focus on automotive aluminum evolved? What are the prevailing major trends today?

Lightweighting remains crucial for both traditional Internal Combustion Engine (ICE) vehicles and Battery Electric Vehicles (BEVs). BEVs, due to their battery systems, are significantly heavier—by over 1,000 pounds—than ICE vehicles. Automotive aluminum is the ideal metal to balance this weight, enabling BEVs to meet customers' range requirements. It also allows automakers to design the larger vehicles customers desire while supporting CO2 reduction goals, an effort the aluminum industry has pursued for decades.

The target of achieving 50% electric vehicle (EV) sales by 2030 is a voluntary goal. According to automotive production forecasts by third-party research firm Global Data, EVs may account for around 40% of the automotive production mix by 2030. Another factor to consider is that between 2022 and 2030, over 300 new vehicle models will be launched, with the majority (over 55%, I believe) expected to be pure EVs (Figure 3). Clearly, this will be a major trend in the future. However, these figures also indicate that 45-60% of vehicles by 2030 will still be ICE-based models, which must still comply with CO2 regulations. Just as pure EVs need to reduce weight to improve range, ICE vehicles also need to enhance fuel economy. Therefore, lightweighting remains a key issue to be addressed in the next decade.

Over the past decade, the industry has announced investments of approximately $9 billion to support automotive growth, encompassing both internal combustion engine vehicles and pure electric vehicles. This is a pivotal and core market for the aluminum industry, involving rolling mills, extruders, forgers, and foundries.

How does the growth trend of automotive aluminum in North America differ from that in Europe? The first distinction lies in the differing regulations between the United States and Europe. The U.S. remains focused on CO2 reduction targets, allowing original equipment manufacturers (OEMs) to determine their mix of internal combustion engine (ICE) and pure electric vehicles (EVs) based on their consumer base. In contrast, the European Union (EU) is mandating the phase-out of ICE vehicles by a certain deadline, with each country setting its own specific goals. Vehicles in the U.S. also tend to be larger than those in Europe. Larger vehicles require bigger engines and wheels, necessitating more aluminum castings. This also means an increased demand for lightweighting to meet CO2 requirements. Consequently, the U.S. has historically led in automotive aluminum content per vehicle and, therefore, in overall demand. However, given the EV push observed in the EU, Europe will eventually surpass the North American market in terms of automotive aluminum content per vehicle.

The aluminum content in the automotive industry is on the rise and will continue to grow. As this trend progresses, how has the automotive industry's focus on aluminum evolved? What are the prevailing major trends today?

Lightweighting remains crucial for both traditional Internal Combustion Engine (ICE) vehicles and Battery Electric Vehicles (BEVs). BEVs, due to their battery systems, are significantly heavier—by over 1,000 pounds—than ICE vehicles. Aluminum is the ideal metal to balance this weight, enabling BEVs to meet customers' range requirements. It also allows automakers to design the larger vehicles customers desire while supporting CO2 reduction goals, an effort the aluminum industry has pursued for decades.

The target of achieving 50% electric vehicle (EV) sales by 2030 is a voluntary goal. According to automotive production forecasts by third-party research firm Global Data, EVs may account for around 40% of the automotive production mix by 2030. Another factor to consider is that between 2022 and 2030, over 300 new vehicle models will be launched, with the majority (over 55%, I believe) expected to be pure EVs (Figure 3). Clearly, this will be a major trend in the future. However, these figures also indicate that 45-60% of vehicles by 2030 will still be ICE-based models, which must still comply with CO2 regulations. Just as pure EVs need to reduce weight to improve range, ICE vehicles also need to enhance fuel economy. Therefore, lightweighting remains a key issue to be addressed in the next decade.

Over the past decade, the industry has announced investments of approximately $9 billion to support automotive growth, encompassing both internal combustion engine vehicles and pure electric vehicles. This is a pivotal and core market for the aluminum industry, involving rolling mills, extruders, forgers, and foundries.

How does the growth trend of automotive aluminum in North America differ from that in Europe? The first distinction lies in the differing regulations between the United States and Europe. The U.S. remains focused on CO2 reduction targets, allowing original equipment manufacturers (OEMs) to determine their mix of internal combustion engine (ICE) and pure electric vehicles (EVs) based on their consumer base. In contrast, the European Union (EU) is mandating the phase-out of ICE vehicles by a certain deadline, with each country setting its own specific goals. Vehicles in the U.S. also tend to be larger than those in Europe. Larger vehicles require bigger engines and wheels, necessitating more aluminum castings. This also means an increased demand for lightweighting to meet CO2 requirements. Consequently, the U.S. has historically led in aluminum content per vehicle and, therefore, in overall demand. However, given the EV push observed in the EU, Europe will eventually surpass the North American market in terms of aluminum content per vehicle.

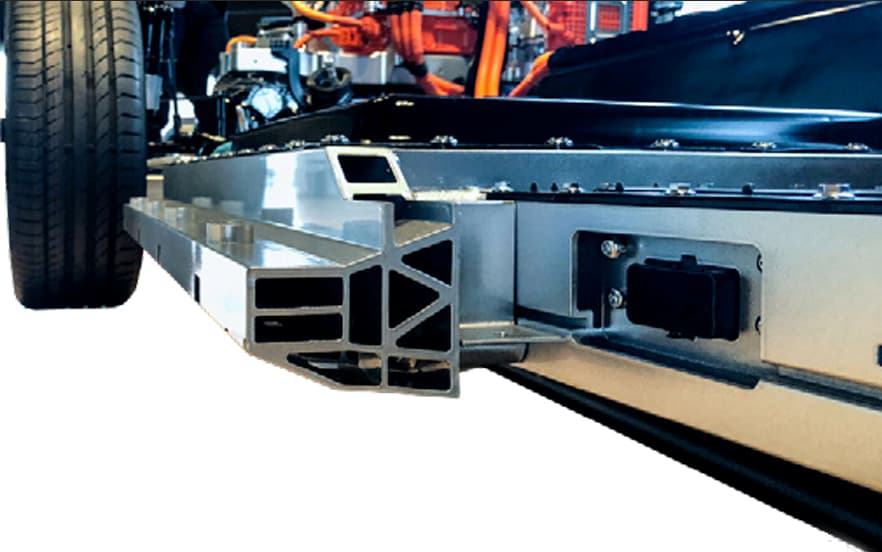

Extrusions are the next major category, playing a pivotal role in the transition to electrification. They are virtually regarded as the backbone material for many battery enclosures. In terms of key applications, as I mentioned, battery enclosures will be a major growth area for aluminum across various product forms. They utilize sheets for the top and bottom covers, aluminium extrusion profiles for frames or crossbeams, and there's also potential to replace multi-component frames with giga-castings. While EVs don't require traditional powertrain components like engine blocks and cylinder heads, the aluminum used in these parts is being offset by increased aluminum use elsewhere, including castings for motor and electric drive housings, as well as the gearboxes they connect to. Additionally, many electronic components like inverters and converters in EVs need to be waterproof, creating further opportunities for Aluminium slot profiles and aluminium extrusion profiles content.

From the aluminum industry's perspective, our role is to support OEMs by providing solutions—we know automakers are focusing on multi-material strategies. When considering weight reduction and range enhancement, they're exploring ways to lower costs for batteries and other components while making them smaller and more efficient. The market is undergoing significant changes, from vehicle types to battery and charging infrastructure, as well as the implementation of new technologies in vehicles. Lightweighting and aluminum have a very promising future.

online service

online service +86 13696864883

+86 13696864883 sales@foenalu.com

sales@foenalu.com